Effective FP&A can help organizations to make better decisions, manage risks, and achieve their financial goals. It requires a deep understanding of financial data, analytical skills, and the ability to communicate complex financial information to stakeholders in a clear and concise manner.

Our financial planning and analysis (FP&A) is the process of forecasting and analyzing an organization's financial performance to make informed decisions about future investments, financial strategy, and operations. It involves creating budgets, analyzing financial data, identifying trends, and forecasting future performance.

1

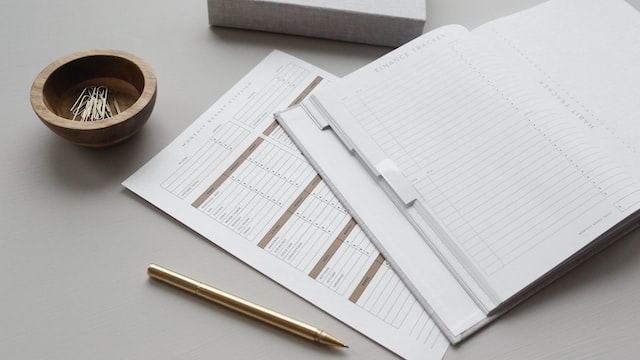

Preparing Budgets by Forecasting Revenues and Expenses, Analyzing past Trends, and Estimating Future Growth.

2

Forecasting Future Financial Performance

3

Analyzing Financial Data to Identify Trends, Opportunities, & Risks

4

Measuring & Evaluating Financial Performance against its Goals & Benchmarks

5

Creating and Distributing Financial Reports that Summarize the Organization's Financial Performance

6

Contributing to the Organization's Strategic Planning Process by Providing Financial Analysis and Insights

7

Monitoring the Organization's Financial Performance and Identifying areas where Performance is Falling Short of Expectations

8

Identifying and Assessing Financial Risks that could Impact the Organization's Performance

Software Expertise